Life insurance policy provides the means for the insured to provide financial protection. For his or her spouse, children, and other dependents. The insurance company agrees to pay benefits in the event of death during a defined period of time. If an insured person becomes disabled or meets other specified contingencies. A life insurance policy does not cover old age. But it does cover any of the following contingencies in which life might be shortened.

What is a life insurance policy?

A life insurance policy is an agreement between the insured and the insurance company. The insurance company agrees to pay a stated amount in exchange for a premium paid by the insured. Usually, these policies are issued for fixed periods of time. On maturity, a life insurance policy is often renewed. Life insurance policies can be issued for as short as six months to as long as twenty or thirty years. Sometimes life insurance policies have a “nonforfeiture clause”. In which the premiums are not refundable. If the insured becomes disabled, dies, or has a specified portion of the payment due to a continued disability.

What is the difference between life insurance policy and an annuity?

A life insurance policy is an agreement between the insured and the insurance company. The insurance company agrees to insure against specified events that might shorten one’s lifespan. A life insurance policy can cover death, disability, or a specified period of recuperation. Annuities, on the other hand, are contracts between the insured and an insurance company. That pays a fixed annuity for a predetermined period of time. Depending on the type one is subject to tax rules in determining if it is an annuity or life insurance.

What does consideration refer to in this insurance?

The consideration money paid to purchase a policy is called the premium. It must be stated clearly in the contract. Right now Canada changed its wording from ‘paid directly by you’ to ‘paid through your employer or investment plan.

What does contingent refer to in this insurance?

Under the terms and conditions of the policy. The insurer is obligated to pay benefits. In the case of a death, disability, or specified event such as permanent illness. These contingencies are refer to as “contingent” obligations.

What is compounding interest?

Compounding is interest that compounds year after year on money already earned. This can use when calculating term Life insurance policy rates. If you know an insured’s annual income and length of time left in life.

How does a this insurance work?

In case of the death of the insured person. Whenever that may be, the life insurance policy will pay out a specified amount to the beneficiary. Life insurance proceeds can provide financial support as well as emotional support. Life insurance is consider an important component of financial planning. For some, it is a matter of peace of mind and for others, it represents a sound investment. In most cases, the full amount of the insurance payout will pay out in one lump sum. However, some policies allow for life insurance proceeds to be pay out over a period of time.

What does liquidity refer to in this insurance?

In financial jargon ‘liquidity’ relates to how easily you can convert your investment into cash. If you have invested in stocks or bonds. Then there are points when you need to sell your assets before the maturity date and take cash from them; so this ability is very important from your end. One of the main concerns that most people have while purchasing Mutual funds is the liquidity needs. If you are living off the interest income and dividend income from your investments. You might need to sell some of your Mutual fund holdings every now and then due to emergencies.

The cash value in a life insurance policy is available upon maturity or it can be accessed anytime during the policy term in case of an emergency or if you want to invest in another investment vehicle. One thing to keep in mind is that it takes time for money invested in a life insurance policy. To become available as loan value or cash value. The entire process goes through underwriting, approval, and claims settlement procedures before one can access one’s funds.

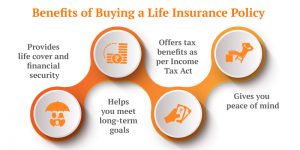

Benefits of this insurance

Whole life insurance is an essential part of any financial plan, there are other benefits that it offers too. The cash value in a life insurance policy can be access. At any point during the policy term as per your needs. However, you should keep in mind that accessing your cash value comes with certain penalties. And charges that can affect your future returns on investment. Also, if access to funds is done frequently, it might hinder the growth potential of the policy. Ensure that you have sufficient cash needs available. Before you take out a life insurance policy so as to avoid frequent withdrawals. And still have time for your investments to grow and provide you with adequate retirement income.